This year has seen many of us re-evaluate our financial position. Rising interest rates, the after-effects of COVID, the regional booms and plunging property prices along with the Great Resignation – all saw us taking stock of where we are, and where we want to be.

Never before have we seen a time when good financial advice was so paramount.

Times of significant change can be a rocky road for your finances and the decisions you make. Emotions can run high and cloud our judgement.

If you had a Financial Advisor throughout this period, no doubt you will have seen the benefit of their advice through a turbulent period. For those who navigated on their own, let’s show you the 5 ways a Financial Advisor can help you.

It’s as simple as…

A+B+C+E+T

A is for Appropriate asset allocation

Asset allocation can be the be-all and end-all of investing.

It has such a powerful impact on your investing success and achieving your goals.

You need to ensure you have the right asset allocation that matches your end goal and your risk profile.

Are you an engaged investor who likes to build your own portfolio? Or are you more of a set-and-forget investor?

What about your risk appetite? Can you hold your nerve during tough times? Or how likely are you to doubt your plan and pull your money out?

This is where a professionally managed portfolio can be of assistance. It is common in turbulent times to see DIY portfolios veer away from their initial asset allocation. This does not always have the best outcome.

An advisor can professionally manage your portfolio ensuring a good asset balance whilst minimising risk for long-term success.

B is for Behavioural coaching

Our behaviour plays such a large (and often undervalued) role in investing.

COVID was proof of the benefit of staying the course during a down cycle.

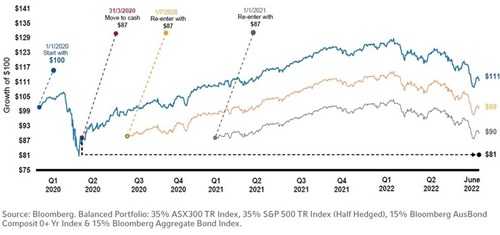

As the below graph shows, those who fled the market in March 2020 would have found the going tough when trying to re-enter the market. Markets bounced back a lot quicker than anticipated.

Fear can take over and have a big impact on potential future opportunities.

An advisor will help you stay on track and avoid emotional decisions.

C is for Choices and trade-offs

Our lives are constantly changing which means shifting priorities on a regular basis.

It’s called decision fatigue.

We have it in everyday life – like what to make for dinner for instance.

Let alone your investments which bear a much greater impact on your future wealth.

An advisor can take the decision-making brunt off your shoulders.

(you still have to figure out your dinner though).

E is for Expertise – emotional and technical

A good Financial Advisor is like having a friend that helps you through your lifelong financial and personal journey.

They are advice-givers at the best and the worst of times.

When you buy a house, start a family, change jobs, invest to end of life decisions, wills and succession planning.

It can be a lifelong relationship – and a fruitful one at that.

You’ll feel more secure, ready to deal with what life throws at you and have peace of mind that your finances are in good order.

T is for tax-smart planning and investing

Financial Advisors can assist with implementing the most tax-effective approach to investing. You want to ensure the decisions you are making are a good idea for your overall tax position.

Whether you are an individual or a business, Financial Advisors can assist with strategies to ensure you are in the best tax position possible – through all stages of your life. Our Financial Advisor Paul has over 20 years of accounting experience to assist our clients and maximise opportunities that arise.

If you’d like to have a chat with one of our Financial Advisors, book an appointment today.