Diversification.

It’s the investment buzzword.

Yet for good reason.

Over time, phases and hot things come and go. Yet the tried, tested and true can withstand the test of time.

And leading the list is diversification within your investment portfolio.

So, if you were to sit the diversification test today – would you pass or fail?

The age-old saying

We have all heard the term to not put all your eggs in one basket.

Allocate this saying to your investment portfolio and you are already ahead of the game.

Diversification, when speaking in investment terms, is spreading your money across a range of assets, as opposed to allocating them all to one asset alone.

Why diversify?

Diversification is one of the core principles of effective investing. It means you are spreading and minimising risk as returns from different assets are seldom consistent.

Asset classes are ever-evolving and changing, so spreading them out will effectively smooth your overall returns over time.

Investing is for the long term, so long-term gains must be considered.

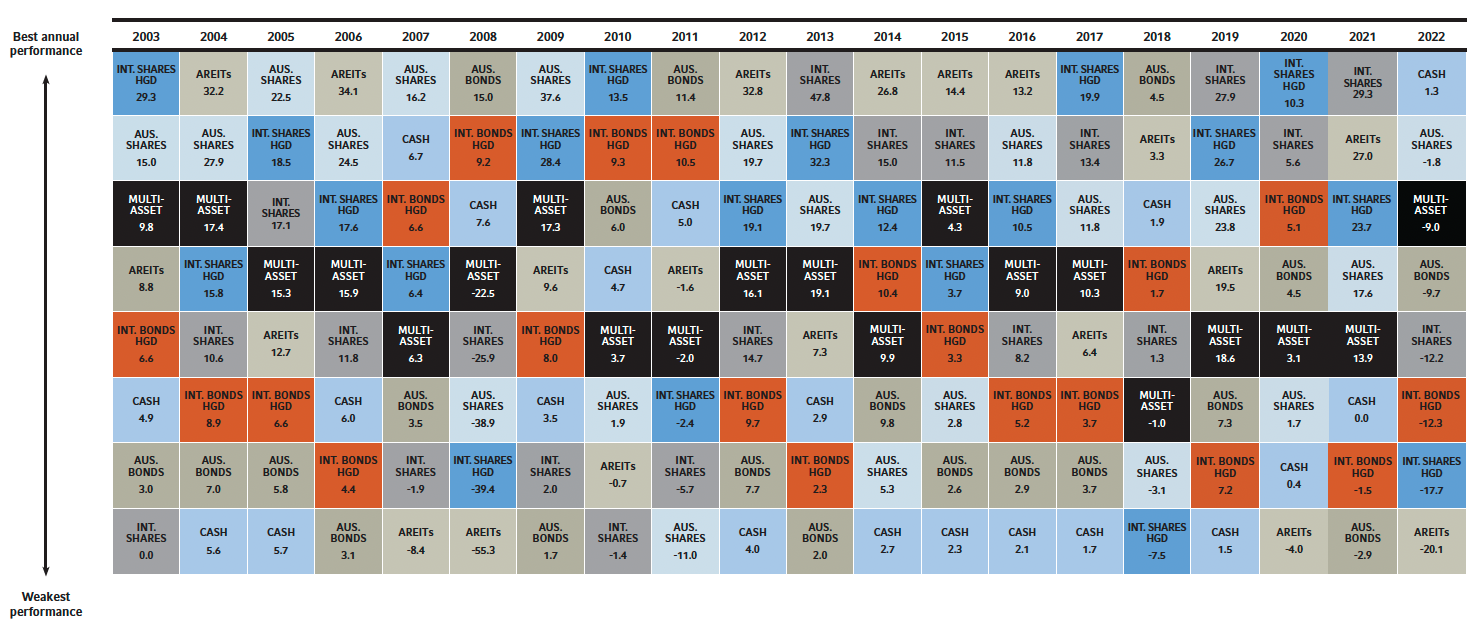

For example, the below table illustrates how different asset classes have performed relative to a multi-asset portfolio diversified across multiple assets over the years. It shows how the same asset class can be a winner one year, and limping to the end on another.

History does show us that not one asset class has continually outperformed all others over time. Focusing on the short term does not guarantee fast wealth. Focusing on long-term, with a diversified portfolio is backed up by the numbers below.

source: Russell Investments

How do you ensure the right asset mix?

This is where the harder work begins!

If we all had crystal balls, we’d know exactly where to hedge our bets.

The best place to start is by reviewing your financial goals and your risk tolerance. As much as investing is hard numbers, the decisions you make first off come from a very personal space.

Many hardworking Aussies are investing in the stock market, looking at a range of assets from Australian and international shares, listed property, fixed interest and cash using diversified exchange-traded funds (ETFs) and unlisted managed funds. Diversifying their investment across a broad range of asset classes.

Diversified funds can also be a cost-effective way to invest with a choice of high, medium or low-risk options.

By investing in diversified funds, you’ll be more likely to stick to a disciplined approach, rather than pulling out when assets dive and losing out. The road will be a little smoother with fewer and less impactful bumps along the way compared to if you bundled all those eggs into one asset class.

The best way to start is to simply get started.

If you’d like to discuss your investment portfolio, get in touch with us and make an appointment for a financial planning discussion.