As a species, we crave interaction. It is an essential ingredient to what makes us human.

The richness and versatility of our communication abilities is unique to the human race.

So, surely it makes sense to seek out advice from our kind in times of need?

When AI just doesn’t cut it

Artificial Intelligence is more and more becoming the norm in society. Don’t get us wrong, there are times when AI is great – life-altering even.

But when it comes to dealing with your finances and decisions that can affect your family’s well-being, do you really want to take advice from what is essentially, a robot?

Comparing a financial advisor to a bot

It’s like comparing apples with well, fake apples. There is just no comparison.

The best way to get to the bottom of this comparison is to think about what you really want as the outcome with your financial advisor.

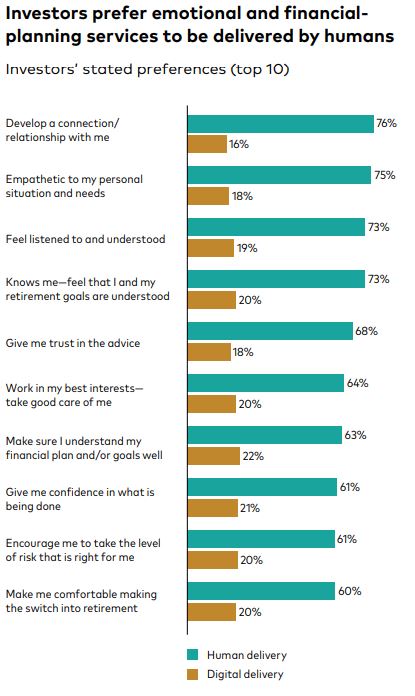

See the results below of a Vanguard survey of more than 1,500 advised U.S. investors.

The positive results of human-delivered financial advice far outweighs a digital-only service.

Of note, was the importance of developing a connection and relationship with the client.

No one does that better than a human.

To help clients meet their future financial goals, a true understanding of their needs and wants is needed.

Trust needs to be built and emotions managed.

Is there such a thing as robotic emotional management?

We know when it comes to any type of financial decision, whether it be to buy or sell property or invest, emotions are involved.

We cannot underestimate the importance of emotional management when it comes to financial advice and management.

Human interaction takes into consideration emotional attachments to property and investments you have.

Let’s look at some scenarios.

- It may make sense from a financial position to sell a property. However, you may have emotional ties to the property and will do everything in your power to retain it. These emotions can skew your perspective and can directly impact your financial future.

- Or, you may have had a personal dislike for a certain investment. It has caused you nothing but trouble.

- You may have had a terrible personal experience with a provider such as Telstra and don’t want to invest with them.

- Or finally, you may have strong ethics or environmental preferences towards certain investments.

Can a robot help you to navigate these complexities around your investments?

Can they provide the emotional management required to make sound financial decisions that not only benefit your finances but your emotional and ethical well-being?

Likely not.

A human third party will ensure you maintain perspective and give you an unemotional, unbiased opinion.

They’ll provide comfort, support, advice and guidance when things get tough or emotional.

Whilst these attributes may not be the first thing you think of when you are looking for a financial advisor – we can guarantee you’ll appreciate them when it comes to the crunch.

They will help to keep your emotions in check and keep you grounded.

Digital platforms may pump out facts and figures in black and white, yet a qualified financial advisor can give you an array of options looking at many different outcomes suited to your individual needs.

And you really cannot get any better than that.

If you’d like to have a chat with one of our Financial Advisors or Accounting team, book an appointment today.