Timing is everything – or is it?

We have just passed the three-year anniversary mark of the onset of COVID. Now doesn’t that seem like a bad dream?

So three years on, what has the financial fallout been?

Did you cash out in 2020? Or did you stay invested and ride it out?

Let’s chat about the difference if you sold in the low and tried to time buying back in, or stayed invested.

And which option is better in the long run?

The 2020 Australian stock market

COVID caused a massive stir of investor panic. Investors were cruising on the massive highs of February 2020, to see the market seemingly fall out from under their feet a mere month later.

The Australian share market saw a loss of 35 per cent, reaching its lowest level in more than a decade on 23 March 2020.

Fast forward three years…

The following three years the market was volatile. Economic, commercial, and political factors saw tumultuous market conditions.

Yet, here we are. Three years later and the market is trading 60 per cent higher than in March 2020.

The cost of jumping ship

So let’s compare the figure.

Was there a loss or a gain for those who sold back in 2020, only to try and rebuy back in six months later?

If your money stayed invested, how would it stand today?

Case Study 1 – Investor A

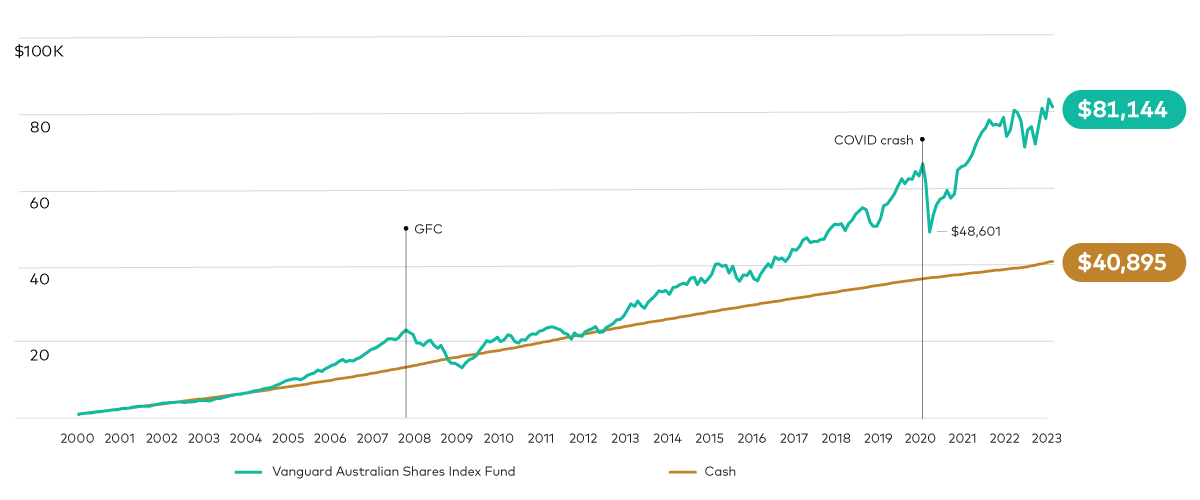

Investor A invested $1,000 into the ASX 300 in January 2000 and made regular contributions of $100 per month and reinvested their distributions.

(This case study is similar to your Super whereby you have an initial investment and receive regular employer contributions.)

By January 2020, their initial investment of $1,000 stood at $66,300.

By March 2020, the value had dropped to $48,601.

Investor A got spooked and pulled out of the market and reinvested their proceeds into cash (at a time of record-low interest rates).

Had Investor A not sold out in March 2020, continued to make regular $100 monthly contributions and reinvest all their fund income distributions, their investment would have been worth $81,144 by March 2023.

That’s a lost financial gain of $32,543, equivalent to compound investment growth of around 67 per cent.

Meanwhile, the $48,601 they pulled out and invested in cash would have increased to just over $53,000.

Case Study 2 – Investor B

Investor B sold out of the Australian share market completely in March 2020 to reinvest in September 2020 after the Australian share market had rebounded.

Investor B similarly invested $1,000 into the ASX 300 in January 2000 and sold at the bottom of the market in March 2020.

Similar as Investor A, they made regular contributions of $100 per month and reinvested all their fund income distributions. By late March 2020 their investment had risen to $48,601.

They decided to wait it out through the market volatility and parked their money in cash (still depositing $100 in savings per month). As the share market started gaining ground they reinvested their cash back into the same investment fund in September 2020.

In essence, Investor B was out of the Australian share market for six months – missing out on the market’s 38.5 per cent rebound between late March and September 2020.

Investor B sold in March and reinvested in September with regular $100 monthly contributions and reinvested all fund income distributions. Their their investment would have grown to $75,248 by the start of March this year. Compared to the total of $81,144 if they stayed invested, that’s a loss of $5,900.

The proof is in the figures

Source: Vanguard.

Calculations are based on a $1,000 investment into the ASX 300 from 1 January 2000 to 28 February 2023 with additional $100 monthly contributions and the reinvestment of all income distributions. Total returns are before fees and taxes.

It’s about what you save

The benefit of sound financial advice can help you avoid the temptation to sell when times get tough.

Turbulent markets can cause rash decisions you may regret in the long term.

Markets rise and markets fall. But historically, they always recover. And those that stay the course benefit in the long term.

Trying to time when markets will rise or fall is generally a losing strategy.

The smart strategy is to stay invested, leverage compounding returns and low investment costs.

If you do, you’ll see the benefit in the numbers.

If you’d like to have a chat with one of our Financial Advisors or Accounting team, book an appointment today.