Last month we discussed how fixed-term annuities can be used to fill income gaps and provide income certainty in the years leading up to pension age.

This month we look at how they can be used to fund the costs of residential aged care, which we know comes at a high cost.

Using fixed-term annuities to Fund Aged Care Costs

For any family, the move to Aged Care is a tough decision, both emotionally, and financially.

One of the main financial concerns with the move to an aged care home is often around having enough cash flow to fund costs.

Ongoing costs can be high if you decide on a room with bundled extra services or if you plan on accessing many of the additional services the facility offers.

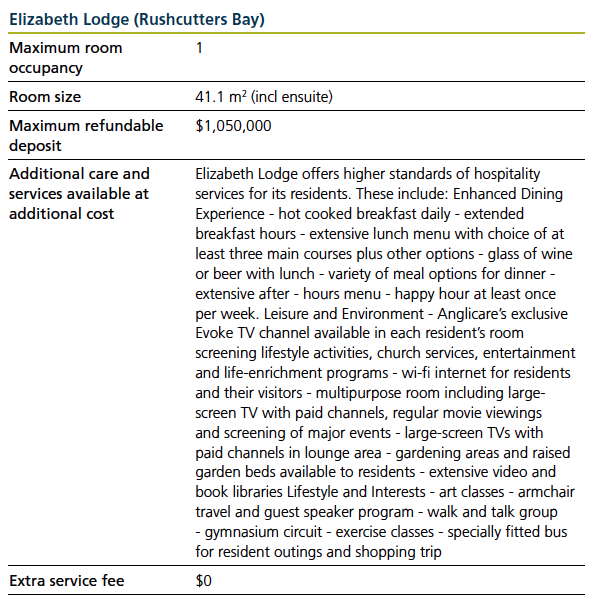

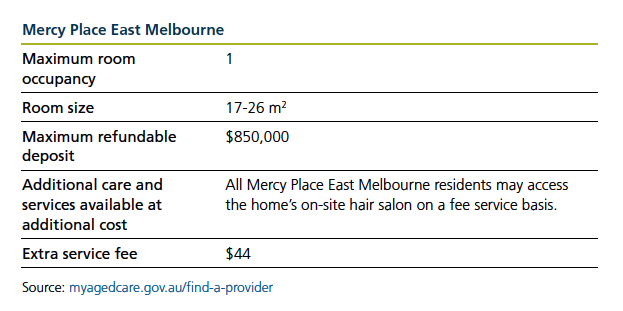

Extra services and additional services are hotel-type services with examples of the types of services offered by the two facilities found below.

You can see the difference between the deposit required for the type of room and services.

Supplementing income using a term annuity

Term annuities can be used in aged care cash flow strategies to supplement the income from other investments.

This can be particularly useful for residents who will likely reach their means-tested care fee lifetime cap over a period of time.

Term annuities with a chosen term that matches the period where the lifetime cap is reached can be used to fund the additional cash flow requirements during that period.

Layla’s fixed term annuity stratgey

Layla has entered aged care after no longer being able to cope on her own. She has sold her home to pay a lump sum payment of $750,000.

In addition to the basic daily care fee and the means-tested care fee, she is also liable for additional service and miscellaneous expenses of $50 per day.

She now has $850,000 in cash and term deposits earning 4%.

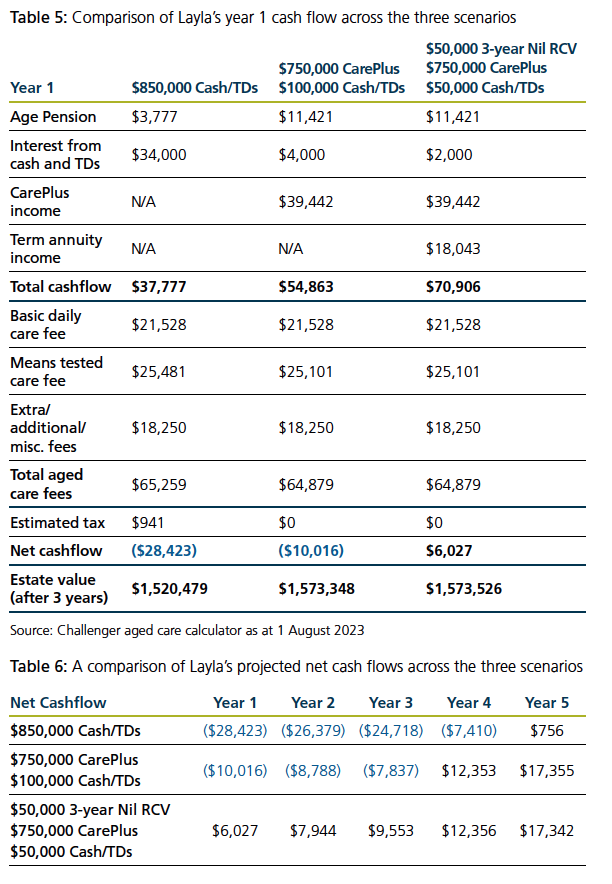

If she invests $850,000 in cash and term deposits, her cashflow shortfall in the first year will be $28,423 (see table 5 below). Her cashflow shortfall will last for the first 4 years (see table 6 below) whilst she is liable to pay a means-tested care fee (she is expected to reach her lifetime cap during year 4 where she will no longer need to pay the means-tested care fee).

If Layla invests $750,000 in a fixed-term annuity such as Challenger CarePlus3 shown below, and retains $100,000 in cash, she can increase her Age Pension entitlement and improve her cashflow significantly.

Her shortfall will reduce to $10,016 in the first year and her cashflow will turn positive in year 4 when she reaches the means-tested care fee lifetime cap.

Layla can consider a 3-year nil RCV term annuity to meet the cashflow shortfall she has in the first 3 years.

If she invests half of her remaining cash in the 3-year term annuity, it will provide her with $18,043 p.a. and her net cashflow will be positive for those 3 years.

Stay tuned over the coming month as we bring you more case studies regarding fixed-term annuities to consider if they are an investment opportunity for you to consider adding to your portfolio.