Over the next couple of months, we are breaking down how fixed-term annuities could help as part of your investment strategy, depending on where you are in life.

As we covered last month, a fixed-term annuity is a retirement investment option that gives you a guaranteed income for a set number of years where your income/cash flow is independent of how the market performs.

So firstly, let’s look at how fixed-term annuities can be used to fill income gaps and provide income certainty in the years leading up to pension age.

Using fixed-term annuities in the lead-up to Age Pension age

Consider May and Mark, who are 67 and 62 years old respectively. They are retired and own their home outright.

After implementing Centrelink sheltering strategies, May has $400,000 in superannuation and Mark has $600,000. They also have $20,000 in personal assets and $30,000 in cash for liquidity.

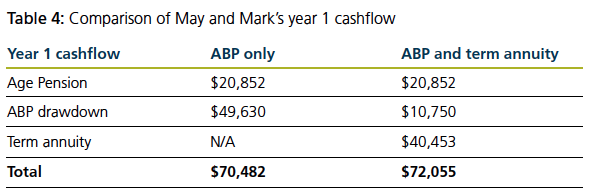

May and Mark are balanced investors comfortable with a 50/50 growth & defensive allocation. As Mark is under Age Pension age (67) his super is not assessed whilst in accumulation phase. This has allowed May to qualify for the maximum rate of Age Pension of $20,852 p.a. (half of the maximum couple Age Pension rate). To fund their retirement, they require $70,482 p.a. (based on the March 2023 quarter ASFA comfortable retirement standard for a 65 year old couple).

One way to achieve May and Mark’s income goal is to simply invest May’s super in an account-based pension and draw down their required income, which is $49,630 in the first year (or 12.4%).

An alternative approach using a RCV0 term annuity

Alternatively, May and Mark can consider investing $185,000 into a 5-year RCV0 fixed term annuity. This will provide income of $40,453 p.a. indexed to CPI until Mark turns Age Pension age.

This also allows them to only have to draw the minimum pension requirement of $10,750 (5%) from the remaining $215,000 in an account-based pension for May to achieve their desired income goal.

The minimum drawdown from May’s account-based pension along with her Age Pension and income from the annuity will provide them with total income in the first year of $72,055. The excess income can be added to their existing $30,000 cash balance.

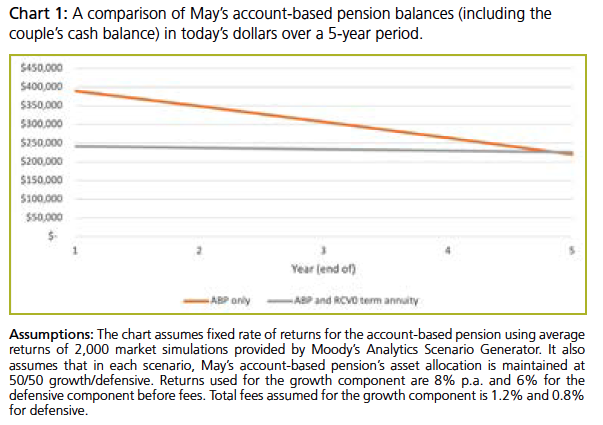

Chart 1 below provides a simplistic projection of May’s account-based pension balances (including the couple’s cash balance) over the 5-year period for each scenario. Based on the assumptions used, May’s account-based pension and cash reserve balances are broadly the same as her balances if she had not invested in a term annuity.

Benefits of using the term annuity

- Based on the assumptions used, the term annuity provides May and Mark with competitive annuity returns and income certainty for the 5 years until Mark turns Age Pension age without affecting their account-based pension capital values at the end of the term.

- The assumptions assume May’s remaining $215,000 in her account-based pension maintains an asset allocation of 50/50. If May and Mark are comfortable, they can take the position that the term annuity forms part of their defensive assets and consider rebalancing May’s account-based pension or Mark’s superannuation to include more growth assets. This can help provide potential for higher returns and super balances after 5 years.

- Where May and Mark experience poor markets, they can choose to turn off drawdowns from May’s account-based pension by rolling it back to accumulation phase (subject to meeting any prorated minimum pension requirements). Under the term annuity scenario, it would mean only forgoing $10,750 (based on the first year) income from the account-based pension. The couple would still have income of $61,305 p.a from May’s age pension and term annuity. This needs to be balanced with any earnings tax of up to 15% in accumulation phase.

Source: Challenger Tech, August 2023

Stay tuned over the coming month as we bring you some case studies regarding fixed-term annuities to consider if they are an investment opportunity for you to consider adding to your portfolio.