We all need a little boost sometimes, right?

The same goes for your investment portfolio.

Know the best way to go about it? It’s just one simple word that can go so far.

Reinvest.

The lure of change

Humans are hardwired to seek out change. To be on the hunt for something bigger and better.

Something faster – a quick fix. An investment that will yield higher returns.

But is it always the best way to go? Will it work out better in the end?

Moreso, will switching up your investment portfolio yield higher returns in the future?

We have discussed in the past the negative effect of time spent out of the market and trying to time the market.

Both risky strategies that are not a fire-safe way to high returns.

Let’s look at an example…

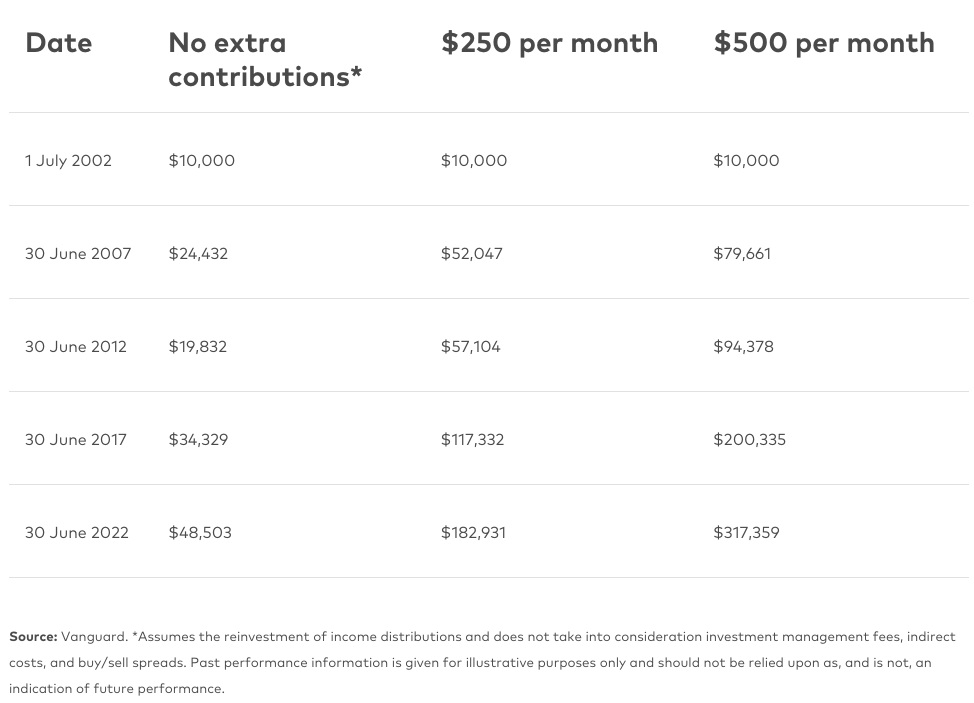

If you’d invested $10,000 into the whole Australian share market back in 2002, your initial investment amount would have grown to almost $50,000 by 30 June 2022. A gain of 385%. Simply by staying invested and reinvesting your dividends.

Add a regular contribution of $250 a month to this for the last 20 years, and the investment would have grown to $180,000. That’s an increase of $130,000 for an investment of $60,000 over 20 years.

Check out the table below for examples of extra contributions per month and the difference this makes to your portfolio value.

The benefit of regular contributions and staying invested

Not bad right?

Introducing dollar-cost averaging

It may sound like a fancy term yet it is one you may already be taking advantage of without even realising it via your Super Fund.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the current price or market conditions. The idea is to reduce the impact of short-term market volatility and take advantage of fluctuations in asset prices over time.

This happens in your Super Fund whereby it receives contributions from your employers which are automatically invested according to your chosen investment strategy. This typically is diversified across various asset classes like shares, bonds, and cash.

With dollar-cost averaging, the amount of money you invest remains constant (your employer contributions), but the number of units or shares you purchase fluctuates (based on the current prices of the managed funds in your super account). When prices are high, you’ll buy fewer units.

When prices are low, you’ll buy more.

The bottom line is, by constantly investing, you’ll benefit from averaging out the highs and the lows. It helps you to avoid making bad investment decisions and pulling funds out based on market fluctuations.

It’s a long game with two rules.

Stay in the game and turbocharge your investment by reinvesting.

If you’d like to have a chat with one of our Financial Advisors or Accounting team, book an appointment today.