Earlier this month we discussed why it pays to stay invested and why it pays to hold strong during turbulent market conditions.

Now, let’s look at how reinvesting will help you stay in the long game, boost your returns and generate long-term wealth.

The Dividend Decision

Reinvesting dividends or distributions from EFTs and Managed Funds is a surefire strategy to build a solid investment portfolio that will deliver strong returns into the future.

Australian companies report earnings on a semi-annual basis around February and August, or May and October (depending on the company).

These earnings announcements allow investors to see how companies are tracking compared to previous years and their intended dividends to shareholders.

It is expected that Australian companies are set to receive $40 billion in dividends from the 2022 financial year alone.

When these dividends are paid to EFTs or Managed Funds, they aggregate the whole amount and distribute to unitholders based on the number of units they hold.

So, if you are on the end of this distribution, what do you plan to do with your dividends?

What is reinvesting?

As a shareholder, you have two options when it comes to your dividends.

-

Cash out

As it says, you can opt to receive your dividends as cash to use how you wish.

-

Reinvest

Reinvesting means you buy additional shares or fund units.

Why reinvest?

Reinvesting helps to continually build your portfolio and put you on track to achieve higher investment returns thanks to the benefit of compound growth.

A higher investment balance means higher future investment returns.

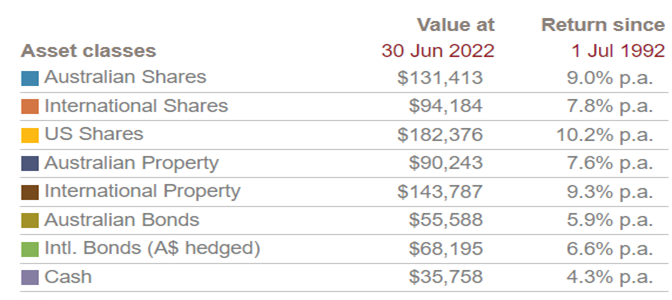

For instance, take a look at the below graph which shows the value of an investment of $10,000 into eight assets, reinvested back into those assets over the last 30 years. (source: Vanguard)

Whilst the results of each asset class differ, the underlying trend is the same – an increase in value over time. Thanks to long-term compound growth.

By taking dividends as cash, you are missing out on the long-term benefit on compound growth and long-term earnings.

How do you reinvest?

Easy.

Many listed companies offer Dividend Reinvestment Plans (DRPs) which will automatically take your cash dividend and reinvest into additional shares.

You don’t need to do anything – just sit back and watch your portfolio grow.

EFTs and Managed Funds generally have this as the automatic opt-in default.

If this automatic reinvestment is not available, you can do this manually yourself and simply purchase additional units once you receive your cash distribution.

Either way, by reinvesting, you are on the track to success and long-term wealth generation.

If you’d like to take your investing one step further and would like to speak to one of our Financial Planners, book an appointment today.