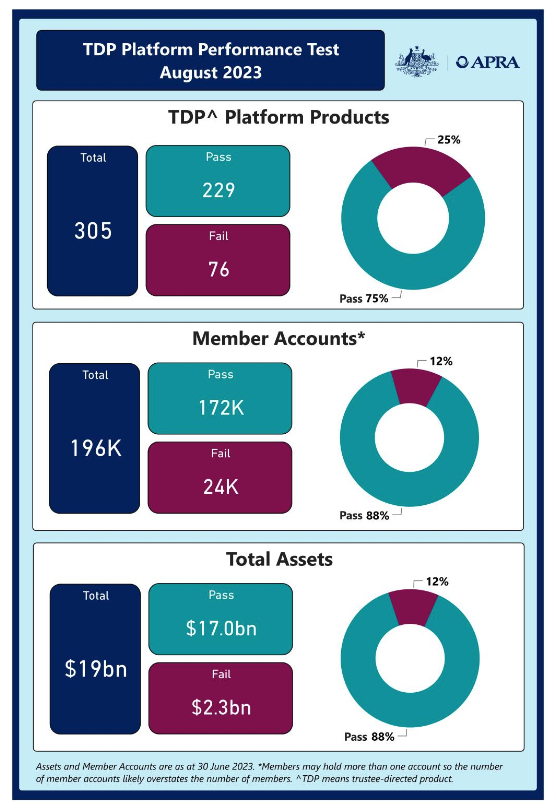

The Australian Prudential Regulation Authority (APRA), the one that ensures Australia’s financial system is stable, competitive and efficient, has released the results of the 2023 superannuation performance test.

The test is performed every year and is designed to improve member outcomes by assessing the long-term performance of superannuation products against tailored benchmarks.

Plus, consequences for those who fail the test.

How did your Super fund rate?

Do you regularly log into your account to check on how it is tracking?

For many people, Super is a set-and-forget. We get it. Retirement may seem a million miles away at this stage of your life.

Yet it is so important to ensure your hard-earned Super is being handled and invested correctly.

Digging into the APRA yearly Super fund test

APRAs test was introduced in 2021 to hold trustees to account for their product performance, fees and costs.

It increased transparency across the industry and held those performing poorly to account.

Not only that, it highlighted results to members who could ultimately decide to stay or choose an alternate fund.

Since this time, nine underperforming products have exited the market with their combined 800,000 members moved to better-performing funds.

A win here for everyone.

Here’s an overview of the 2023 results:

TDP platform performance test results – FAILS

- AvWrap Retirement Service

- IOOF Portfolio Service Superannuation Fund

- MLC Superannuation Fund

- Oasis Superannuation Master Trust

- Premiumchoice Retirement Service

- Retirement Portfolio Service

- The Bendigo Superannuation Plan

- Wealth Personal Superannuation and Pension Fund

Is your Super up for a review?

Is your Super fund on the above list? Then we highly recommend a review and advice on an alternate fund.

Regardless if your Super Fund has passed this year’s APRA test, it is worthwhile looking into a yearly review.

- Is your Fund working the best it can for you?

- Is your Super invested correctly? Do you have the right balance?

- Could it be time to consider a Self-Managed-Super-Fund (SMSF)?

Now could be the right time to book a time with us for a yearly review of your Superannuation. It can be a quick and simple overview of your Fund, its performance and an analysis of your current investment options. Get in touch with the team to discuss your yearly Super review.