When looking at market returns, sometimes we need to step back and put things into perspective.

This latest financial year is one of those times.

It is safe to say it has definitely not been a stellar year for investment returns.

Yet, that is not to say that the coming year will follow in the same footsteps.

What asset may have seen a big dive this last year may prosper in the year to come.

2021 – 2022: The year of volatility

This last year was a volatile one for global markets.

The combination of COVID, the Ukraine-Russia war, turbulence in Chinese markets, rising inflation and aggressive interest rate hikes saw investments teeter on the edge.

No one was safe.

From bonds to commodities, currency and stock – all bore the brunt of a turbulent year with losses across the board (except for a 0.1% gain in cash).

This came as a shock upset for many, following a cracker 2020-21 where markets rose by 30%.

Keeping things in perspective

Assets classes have always, and will continue to vary from year to year. What performed poorly one year may excel the next.

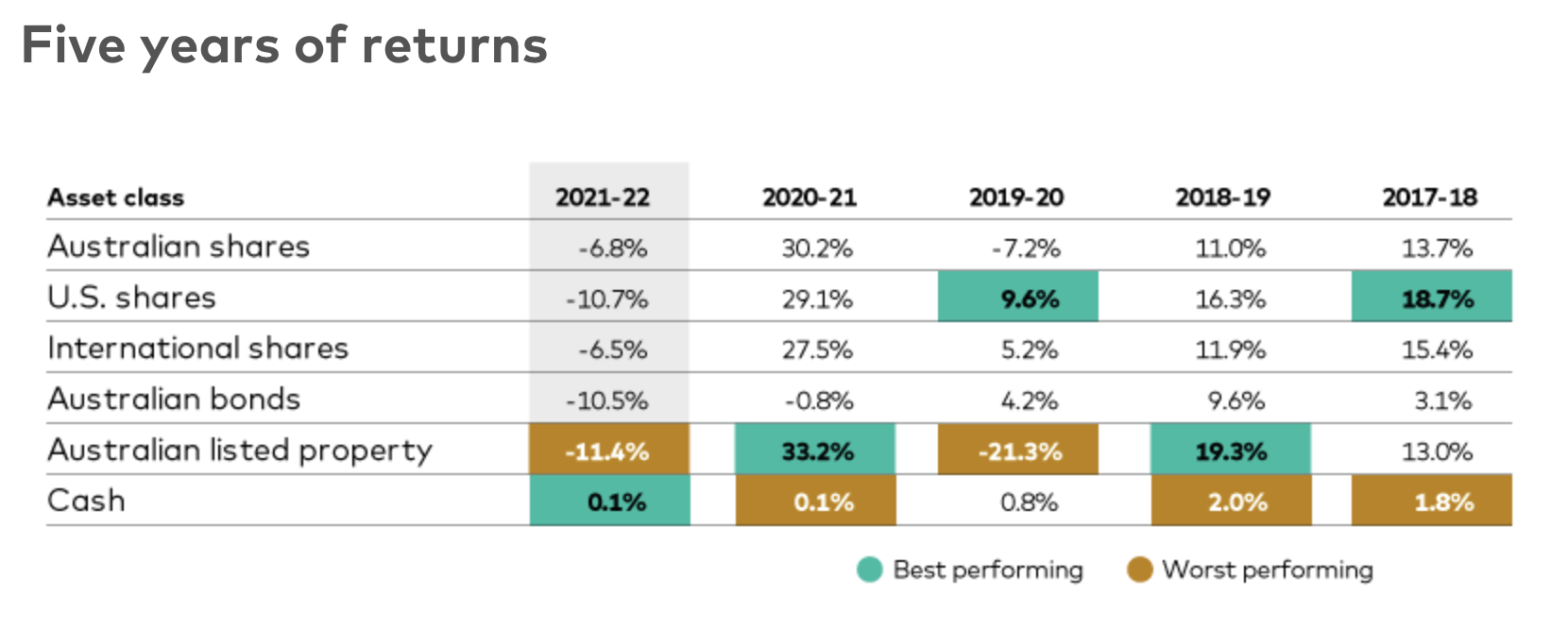

For instance, cash was the only asset to show a positive gain in 2021-2022. Yet in the 2020-21 where all others shone, cash was one of the worst performing assets.

You can see the last five years of returns on the table below (source: Vanguard)

Where to from here?

For those who are unsettled by this year’s investment returns, don’t despair.

Returns from assets vary and are not always consistent.

A wise move is to crosscheck your investments and ensure you have a balanced portfolio. As the age-old investment rule goes ‘don’t put all your eggs all in the one basket’.

Therefore, when we see big market dips across certain assets, you can be buoyed by others in your portfolio.

It is unwise to try to pick a winner each year.

Take a balanced approach instead and spread your investment across a variety of assets.

It will help reduce risk and give you that much-needed buffer in times of market turbulence.

If you’d like to take your investing one step further and would like to speak to one of our Financial Planners, book an appointment today.