To pay down a mortgage or invest? That is the question.

Yet, the answer may not be quite as simple.

It all comes down to a range of factors and your financial situation.

For some, paying down extra debt is simply not an option. With interest rates at a peak and high costs of living, many of us are happy to be making ends meet at this point.

However, if you have a nest egg, a decent savings buffer or receive ad-hoc additional payments like a bonus, pay rise or one-off gift, you may be wondering where is the best place to invest right now.

Is the smarter move to invest or to pay additional payments off your mortgage?

To invest or pay down debt

As with all investing, it comes down to personal choice and a range of additional factors such as your appetite for risk, your current cash flow needs and your overall debt position. There is no one-size-fits-all.

Both options have positives. Paying down a current mortgage means a reduction in monthly payments, interest accrued and overall reducing the life of the loan.

Investing elsewhere such as in the stock market or purchasing an investment property means offsetting debt-servicing costs if the net returns from those investments are higher.

As an example, current variable interest rates for an owner-occupied home sit at around 6%. If net investment returns from the share market sit at 9% annual return, some may say investing is a wiser choice if looking at net returns alone.

Positives for investing outside of your home are negative gearing for investment properties which can be of benefit to some investors. It’s also important to consider the capital gains implications for any investment returns.

There is no crystal ball answer to this question. Yet with the current global market volatility, paying down debt is our recommended course of action for those who are looking for a lower-risk option to divert excess funds.

Let’s crunch the numbers

We know there is no crystal ball for the future. But the best we can do is look at the past as an indicator of what may lie ahead.

Let’s compare two scenarios where Subject A receives a $10,000 bonus. Option 1 is paying down an owner-occupier mortgage of $400,000 with a 5.52% interest rate as a lump sum payment, and option B is investing in shares.

OPTION A: Paying down mortgage over 10 year period with a $10,000 lump sum payment

Let’s take a $400,000 loan taken out in October 2013 = $142,185 interest paid over 10 years.

Subject A received a $10,000 lump sum payment at the start of 2013 and applied to the home loan taking the loan amount to $390,000 = $138,631 in interest paid over 10 years.

That’s an interest saving of $3,554 when compared with the interest on a $400,000 mortgage.

OPTION B: Investing in the share market

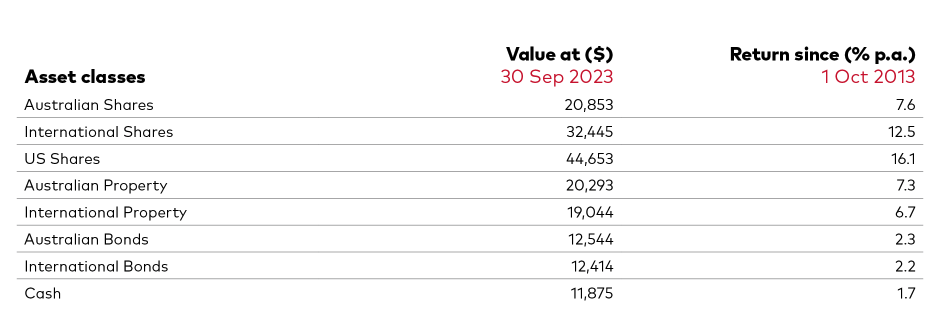

The below table shows the different investment choices and their returns over the past 10 years for a $10,000 initial investment and the reinvestment of all the income (company dividends or other income distributions) received.

Source: Vanguard, Index Charts.

Whilst past performance is not a reliable indicator of future performance, it is clear that on average, shares have achieved the strongest average annual investment returns over the past decade.

If Investor A invested $10,000 in Australian Shares at 7.6% they would be sitting in a slightly better position than paying down the mortgage. Do note this is without factoring in taxes on earnings and potential payable costs.

Investment returns can be volatile and greatly differ from year to year.

It comes down to creating a personal financial strategy that suits your current situation and long-term goals.

If you’d like to discuss your financial goals and investment options, get in touch with us and make an appointment for an initial discussion.