No one wants to be a bad investor. It’s just not where you want to be.

If you are new to the stock market or a seasoned investor but are getting itchy feet with the current market, how do you avoid making bad investment decisions?

It all comes down to history and learning from our and others, mistakes of the past.

Here’s what we have learned from years in the investing game, guiding our clients to the best financial position they can be in.

Don’t try to time the market

If it were that easy we’d all be millionaires.

Timing a market is hard.

You need to nail (all in perfect simultaneous precision) – an indicator of returns, size of the allocation and the precise exit and entry of asset and execution of the trade.

Precise timing is near impossible.

Not only do you need to time the length you are invested, but also to weigh up the time when not investing.

For instance, those who sold shares through COVID to cash, faired weaker than their counterparts who stayed invested as the market bounced back a lot quicker than expected.

For example, an investor who was right 100% of the time would see a 0.2 percentage point advantage in their annualised returns over 25 years when compared to a balanced portfolio. Getting things right 75% of the time would see an investor better off than the base scenario at the end of 25 years by $252. And finally, being right half the time meant underperforming in a balanced portfolio.

It’s the time spent in the market, and the effect of time spent out of the market that all adds up.

Spending time in the market

Nothing sets you up better for a successful investment future than spending time actually IN the market.

Get to know it and how it all works. Contribute regularly. Reinvest your dividends.

Money left in the market has the glorious effect of compounding interest.

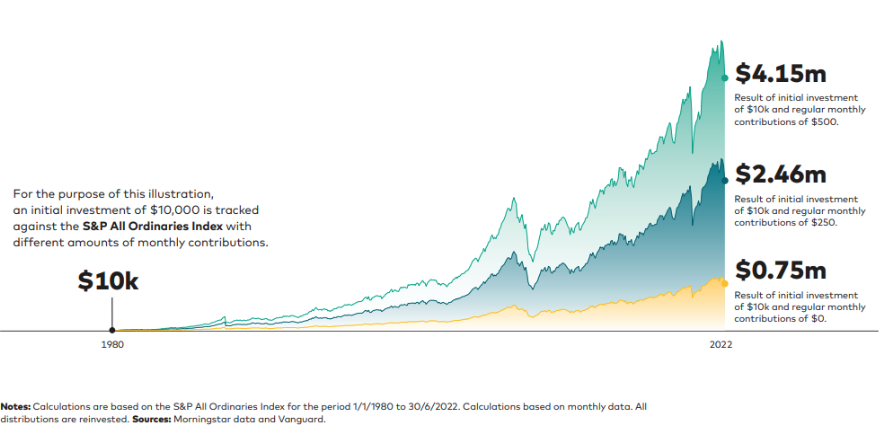

The below graph shows the impact of a $10,000 investment when regular contributions are made. This is all due to compounding interest – the longer in the market with additional contributions, the better the outcome.

Focus on the long term

Let’s say you invested for the first time right at the peak of the market. Right before the crash.

The best thing you can do is not freak out.

The market will return to better days. Focus on the long-term game.

Stop logging into your account and languishing over the negative returns you see.

Log out, sit back and wait for the cycle to turn.

Because, as history tells us, it will turn. And you will see positive gains once again.

If you’d like to chat to us about your financial goals, book a time in with one of the team – we can help you reach your goals quicker and keep you on track.