With all the events happening across the globe, the stock market has taken a bit of a belting.

So what should you do about it?

The very first thing?

Don’t freak out.

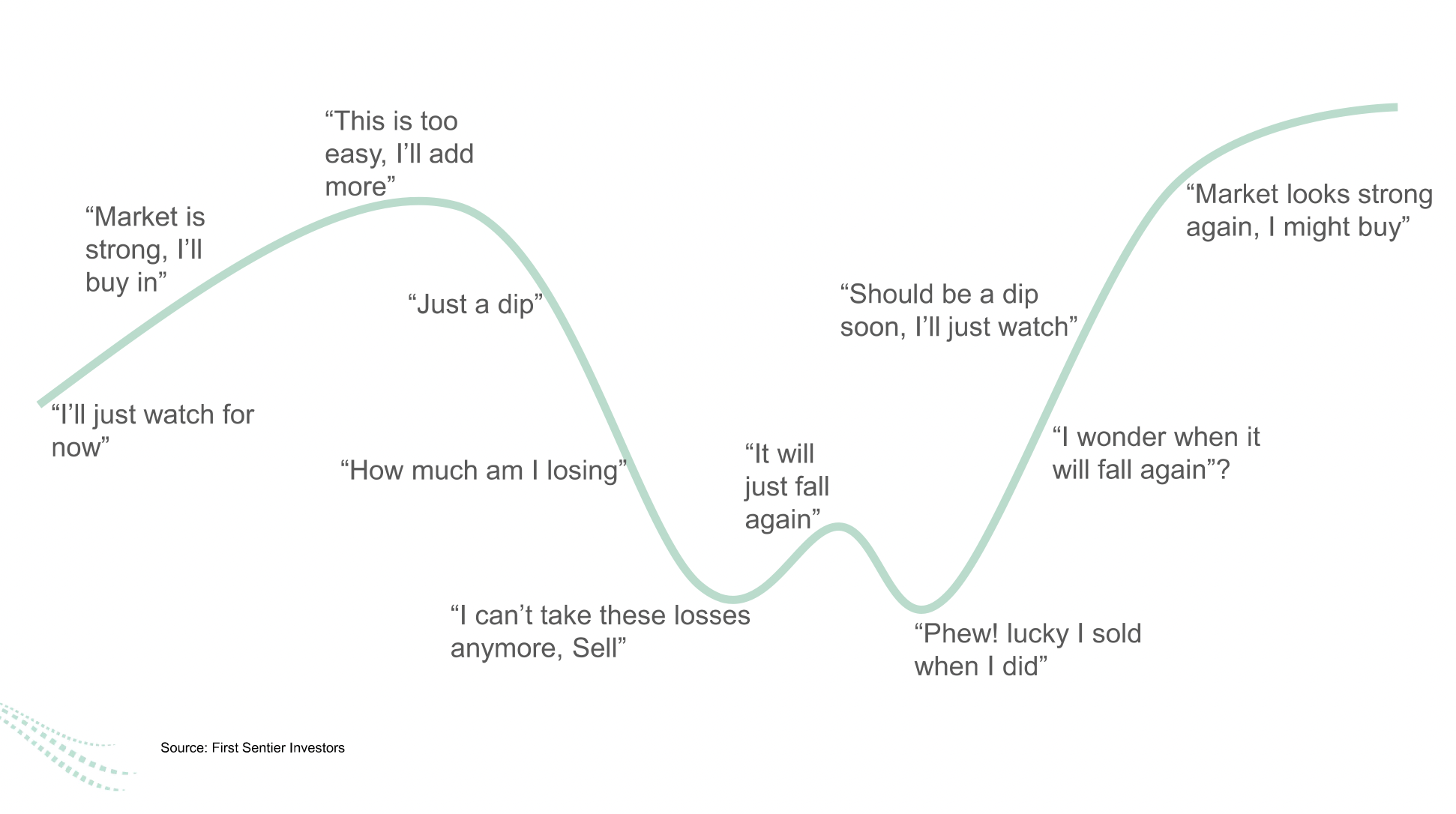

As seasoned investors know and those who have been in the stock market game for some time, the market goes through peaks and troughs. Reaching the highest of highs and the lowest of lows, and switching between the two seemingly overnight.

It is important to remember, investing in the stock market is a long term game. Making rash decisions in the short term can result in long-term negative consequences.

So let’s look at the current scenario we are facing.

Investor behaviour

A recent surge in U.S. annual inflation to a 40-year high of 7.5 per cent, sent global markets into the red.

The result – unsettled investors.

Talk of interest rate rises is rife as banks move to counter rising inflation. Homeowners tighten their purses. Banks tighten borrowing capacity.

So in face of rising inflation, market volatility and interest rate rises, what should you do?

3 mistakes to avoid when the market dips

-

Freak out

As we mentioned above, don’t freak out.

Market dips are normal – they cannot continue to rise indefinitely. There are times it will fall, only to pick back up again.

Making choices based on short term data is a recipe for disaster. Hold your nerve and wait for the storm to pass.

-

Failure to plan

Always have a plan. Even if it is a basic one.

A long term investment plan negates the urge to act spontaneously. With a plan in place, you’ll be less likely to diverge from the end goal. Your reactions to market fluctuations won’t be as severe.

You’ve got an end plan, and you’ll stick with it, despite what happens in-between.

-

Focusing on the losses

We know it is hard to not look at the numbers and feel a pinch of anxiety. But all downturns are par for the course, and sadly, it won’t be your last.

Learn how to weather the storm, rather than packing everything in and running from it.

Remember, shares are a volatile investment, but the long term returns are worth the risk when compared to other assets.

Hold your nerve. The storm will pass.

If you’d like the assistance of a Financial Advisor to help guide your long term stock market plan, give our Fusion Financial team a call.

We can help you put in place an investment plan and guide your ongoing financial decisions based on your individual goals. Sometimes all you need is someone outside, looking in to help guide the best path to take.