The Australian stock market has seen better days.

We haven’t seen such a severe dip since the start of the COVID pandemic.

Rising inflation in the US and the subsequent 0.75 hike in US interest rates saw $116 billion wiped off the Australian share market overnight.

Aussie portfolios plummeted with Bitcoin losing almost a quarter of its value in 36 hours.

Our wealthiest saw billions slashed from their portfolios.

So what does this mean for the average Aussie investor?

Do you cash out or hold?

At the moment there is heightened market uncertainty. It is a volatile market and many fear there is worse yet to come.

Yet, history says, what comes down will inevitably go up again.

As you log into your portfolio, there is the desire to cash out as you watch the value of your investments tumble.

What to do when the market dips

Now is the time to stop and remind yourself of your long-term goals.

Are your goals the same?

Do they match your asset allocation?

If the answer is yes, log out and ride it out.

Here’s why.

The benefit of investing in the long game

Recent Vanguard research found that during the COVID 2020 crash, 80 per cent of investors would be better off if they kept their money invested as opposed to cashing out. Markets rebounded – even better than expected.

If you can hold your nerve, stay in the game.

It all comes down to the level of risk you are willing to undertake. Do not let the current market conditions affect your decision-making. Try as best you can to keep emotion out of the equation.

Markets go up and markets go down. Yes, we are in the midst of a pretty severe downturn – but it won’t last forever.

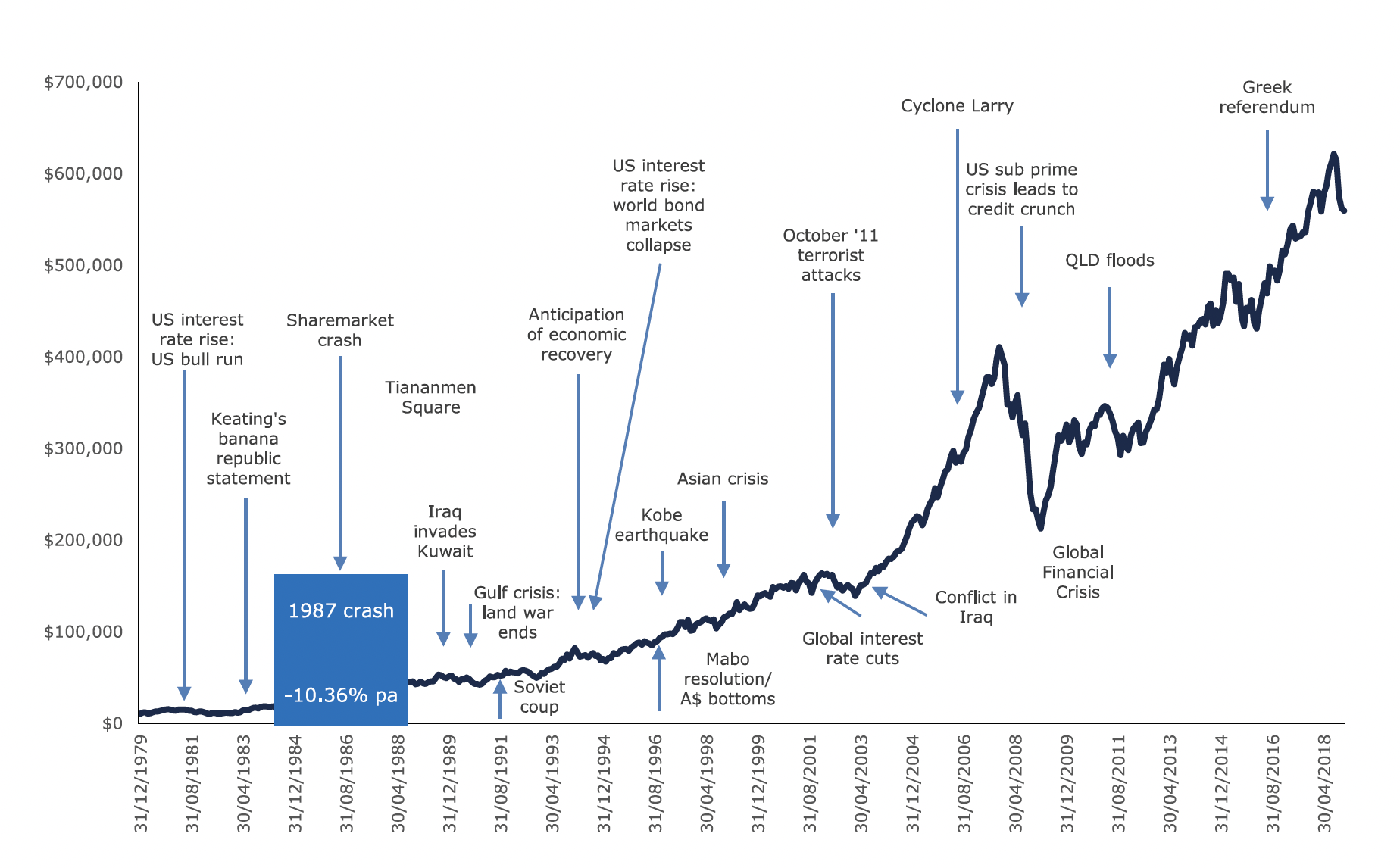

The chart below shows the trajectory of the performance of $10K invested back 1979.

Despite the ups and downs of the market, today that $10K would be close to $700K.

Sure, there were peaks and troughs along the way but the value of investing in the long game is clear.

Are we headed for a recession?

When we look at Australia’s future, we look at what is happening in the US.

With rising inflation in the US, hikes in interest rates and continued global market uncertainty, it is widely believed we may be headed for a recession.

The US is pushing up its interest rates, which historically, have led to a consequent recession (11 out of the past 15 rate rises since the 1950s have ended in a recession)

Whilst there is not a 100 per cent guarantee we will follow suit with US – it does put us on edge.

The cost of living is soaring to new heights. We all know by looking at the cost of our weekly grocery bill, the cost of everyday items has increased to a 41-year high.

All we can do is hope our commodities and low unemployment rate may provide the buffer we need to prevent us from entering a full-blown recession.

So hold onto your hats as we work our way through the coming weeks – we could be in for a bumpy ride.

Be sure to get in touch with your Financial Adviser before making any major changes to your investment plan.