Business banking that works for you

The set up of your business bank accounts is vital to ensure the successful, and stress-free, operation of your business. It sounds simple, yet we see businesses owners who struggle to keep up with their business financial obligations. All of which could be easily avoided with an effective banking solution.

Plus, it is easier than you might think.

Firstly, let’s look at the benefits.

The benefits of setting up multiple business bank accounts

-

Cash flow

Having multiple accounts for different purposes will ensure your business stays cash flow positive at all times.

-

Emergency fund

Setting up your accounts this way ensures you have a build-up of funds in case of unforeseen problems. Which we all know far too well how quickly business can change overnight. COVID, sickness, lockdowns… need we say more.

-

On-time bill payments

Having cash set aside means you can pay your bills on-time as opposed to paying late and stressing over available (or unavailable) funds.

-

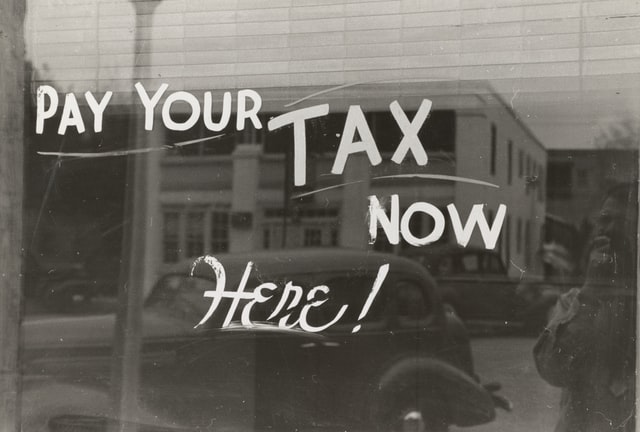

Tax obligations

Again, such as paying bills, when your BAS comes around you have funds on hand to pay your tax obligations on time.

-

Slush fund

These accounts allow you the flexibility to build up extra cash within the business to use as you will.

These 5 points present a pretty convincing argument.

So, now let’s get to the fine print.

How to set up your business bank accounts

You are going to set up 4 separate business bank accounts.

-

Account #1

Account #1 is your day to day business transaction account. Income/sales received and bills to pay.

-

Account #2

Account #2 is for your tax obligations. You will move your PAYG tax withheld and super for employees over every pay cycle along with GST payable. This account will also include any owner’s personal income tax obligations. Your BAS and quarterly super funds will always be available.

-

Account #3

Account #3 is a savings account. This is where we want to build 2 to 3 months of your businesses normal operating expenses. For example, if your outgoing for a month is $25k, you want to slowly build this account up to the $50k – $75k range. This will take time, but it provides valuable security and peace of mind. For many businesses, having these funds in account #3 could have made the COVID lockdown much less financially stressful.

-

Account #4

Account #4 is a surplus account. These funds might be distributed to the owners or invested back into the business. Decisions which can be made with help from your accountant during business review meetings or as part of your business plan.

This strategy does take time to build. Yet the advantages far outweigh the effort it takes to set it up.

By having these funds in place, it gives you time as a business owner, to make important decisions. Especially when things might not be going your way. If you decide your business is no longer viable, you have a pool of funds to pay off creditors as you wind it up. Or you may invest further funds into the business through capital purchases or increase your staffing capacity.

A final note on owner wages

It’s important to distinguish the owner’s wage from the profits of the business. Spending every available cent and working month-to-month is not an ideal way to run a business. Cash flow is extremely important in any business. Implementing the above strategy will enable your business to grow, and more importantly, survive any unforeseen tough times ahead.

If you’d like to discuss how to set up your business bank accounts for maximum efficiency, contact our team for a business review meeting.